Financial Challenges: Bounced Cheques and Unpredictable Situations

We cannot predict that our financial situations will be the same all time. There may be ups and downs. But when we are financially broke, and we don’t have enough money in our bank account, bounced cheque’s turn as a villain against us. And yes, when that cheque bounces?

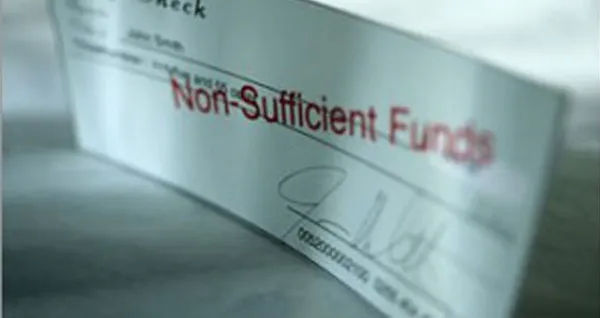

Bounced Cheques: Legal Consequences and Financial Thresholds

When the cheque bounces, depending on the cheque amount, a criminal case shall be filed.

That is if the cheque amount is up to 200,000 dirhams, a fine amount can be paid to the public prosecution instead of serving a jail sentence by the issuer of the bounced cheque. But failure in payment of fine will result in imprisonment.

In case the cheque denomination is more than AED 200,000, it is up to the discretion of the court to issue a fine or grant a jail sentence.

Fines for Bounced Cheques: Amount Breakdown Based on Denomination

The fine amount also varies with the amount mentioned in the bounced cheque.

- From AED 1-50,000- the fine amount reaches 2,000 dirhams.

- From AED 50,000- 100,000- fine amount 5,000 dirhams

- A bounced cheque worth AED 100,000 to AED 200,000- fine comes around 10,000 dirhams.

Legal Consequences: Fine Allocation for Bounced Cheques in Companies

In this case, not all the partners of a company have to face case or troubles. It won’t affect every members, but the one who represented the company for the cheque transaction, which is the authorised person – who signed the cheque has to face the legal consequences.

Cheque Management Tips: Preserve Copies and Acknowledge Legal Responsibilities

- Keep a copy of personal cheques you signed

- Keep an eye on cancelled cheques

If you are signing the cheque as a representative of your company, be aware that you will be legally responsible to honor the financial commitments.