Are you also amongst the ones who are tired of financial stress? If you are also bending under the debt burden, you are not alone. Don’t you want to tackle it in a smarter way? It might be a good idea for you to consolidate your debt. To consolidate debt in Dubai we club all your multiple loans into one single debt. There are several best ways to consolidate debt, which allows you to pay a lower interest rate.

The best debt management plan is often devised and executed by a reputable debt management company known for its tailored financial solutions. Such companies excel in crafting personalized debt management plans that effectively address individual financial challenges, offering a path towards debt reduction and eventual financial freedom.

Consolidate Debt in UAE might be your wisest financial decision as combining your multiple debts into one is a sound approach to tackle your debt. It will allow you to clear off all your debts affordably and in a smarter way. This will also benefit you in terms of saving more towards interest payment and you do not need to worry about your number of payments for multiple debts.

Lotus debt management offers you with the best ways to consolidate debts by which you can clear your debts without paying expensive interest rates. Here are some of the ways by which we can consolidate debts. But it needs to be customized for each individual or organization depending upon the earlier credit report. It also depends upon which is the best suitable financial tool to be used depending upon the obligation and future planned earnings.

A debt consolidation company specializes in merging multiple debts into a single, more manageable payment structure. Through debt consolidation, individuals can streamline their financial obligations by combining various debts into a unified plan, often benefiting from lower interest rates or simplified repayment terms provided by these specialized companies.

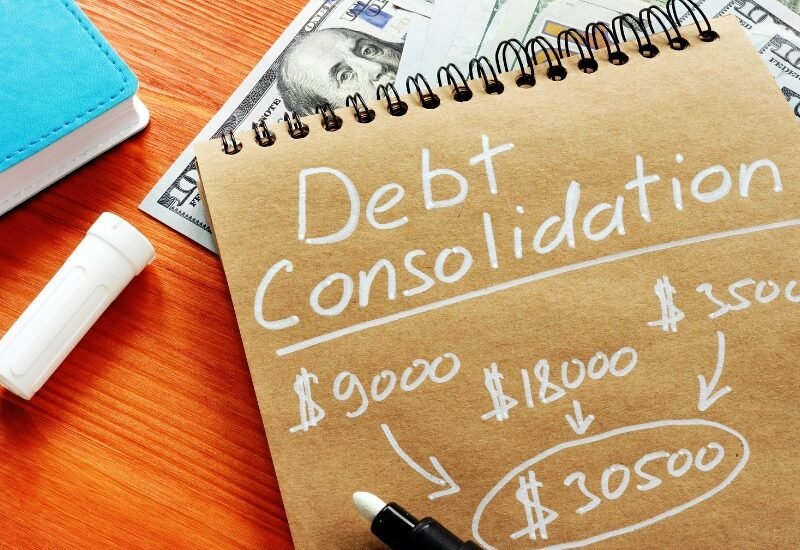

Here is explanations through this example how consolidate debt in Dubai is processed with the help of Lotus loans professionals:

• Debt management program

It is a good option to get into a debt management program offered by Lotus Loans & Overdues Rescheduling Services. Our team of credit counselors will allow you to manage your loan affordably and easily. They will make sure to decrease your overall monthly payment towards debts.

• Credit card balance transfers

If you also have credit card debt you need to give it a try to credit card balance transfers to consolidate debt in Dubai. In this, we transfer multiple credit card balances to a single card with 0% interest rate. But you need to have a good credit score to avail this option.

• Personal loans

Next alternative to consolidate debt in the UAE is applying for a personal loan as these loans do not require collateral and are also available at very low interest rates. You can even take personal loans with your relatives or friends.

• Home equity loans

To consolidate your debt you can tap on your home equity. The interest rates of home loans are typically low but they use collateral as a security. You must own a house to consolidate debt through home equity.

In the UAE, individuals seeking effective debt management often turn to specialized consultants offering instant debt management services. These consultants excel in providing tailored strategies and guidance to navigate the complexities of debt management. Leveraging the expertise of a skilled debt management consultant in the UAE ensures swift access to comprehensive solutions tailored to individual financial circumstances, enabling individuals to regain control over their finances.

Let’s take the example of a person or industry or organization that has outstanding liabilities as follows:

1) A credit card liability – AED 50,000/-

2) Another credit card liability – AED 75,000/-

3) Personal loan from Bank A -AED 250,000/-

4) Personal loan from Bank B -AED 275,000/-

In normal instance, each loan carry separate interest percentage will apply on each of the outstanding liability. Also fixed installment payment will apply for each accordingly. Now our professionals will help & discuss on your behalf with banks to consolidate the loan. The bank treats all of the above liability or loans as one outstanding liability. Bank provides you with a revised lower interest and installment figures at competitive rates. It provides considerable savings & relaxed mind.

Effective debt management involves implementing well-thought-out strategies to tackle financial liabilities, emphasizing the need for good debt management plans. These plans serve as roadmaps, incorporating various effective debt management strategies such as budgeting, debt consolidation, and prioritizing repayments to facilitate a structured approach towards becoming debt-free. Employing a good debt management plan underscores the importance of tailored strategies, aiding individuals in efficiently managing and ultimately reducing their debt burden.

Our professional trained financial consultants in Dubai will gather all information of your multiple debts and roll it into a single debt, by debt consolidation process. We will also guide you to improve your credit score and increase your wealth. Moreover, we will help you to improve your financial situation and let you live a debt free life.

For more information connect with us

+971 50 308 3722 / +971 50 797 9051 / +971 56 159 1000 / +971 55 1098039

gauravbhalla@lotusadvisoryuae.com, gauravchopra@lotusadvisoryuae.com

Please feel free to contact us. We will get back to you within 2 business days. Or just call us now

+971 56 159 1000

gauravchopra@lotusadvisoryuae.com